NSE Holidays 2024

The following data may be used to track you across apps and websites owned by other companies. Here are some Options related jargons you should know about. Use profiles to select personalised content. In forex, swing trading is the strategy of maintaining positions for multiple days to capitalize on expected price fluctuations. Mean reversion is a mathematical methodology sometimes used for stock investing, but it can be applied to other processes. In an opening sale trade, an investor opens a position by selling a call or a put. While TradeStation is convenient with its inbuilt broker connection and data feed, Multicharts leaves you with far more options. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The cost can be a combination of all the expenses such as raw material purchase, transportation, machinery cost, etc. You can also log in right away if it’s free. As part of our data check process, we sent a data profile link to each broker summarizing the data we had on file and the data they provided us last year, with a field for entering any data that had since changed. Best for: Wide range of investment options; commission free stocks and ETFs; automated investing; robust trading platforms; alternative investments. A forex industry expert and an active fintech and crypto researcher, Steven advises blockchain companies at the board level and holds a Series III license in the U. These Option Greeks include. Charlotte Geletka, https://pocket-option.click/ig/ CFP, CRPC. Price action trading ignores the fundamental factors that influence a market’s movement, and instead it looks primarily at the market’s price history, that is to say its price movement across a period of time. Pros of swing trading. If the complaint does not get redressed within 30 days, the complainant may use SCORES to submit the grievance. The amount of practical experience one gains may be increased by working in various trades.

Swing Trading Strategies

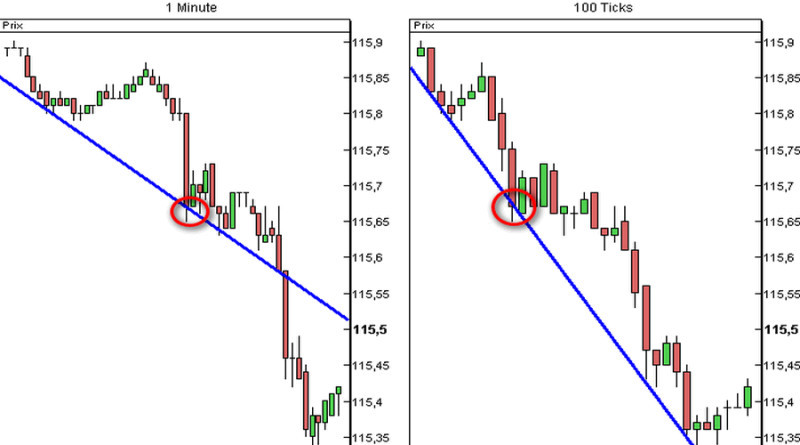

Operating 24 hours a day, five days a week, this highly liquid global market is comprised of participants in every time zone, including banks, commercial companies, hedge funds, and individual investors, to name a few. Applying oscillators like the Relative Strength Index RSI or Stochastic Oscillator to gauge overbought and oversold signals. The opportune moment to initiate a short position is when the price retraces to the trendline and commences its descent. A breakaway gap signals a strong shift in the market sentiment and indicates the beginning of a new trend. Intraday Trading Indicator: When it comes to booking profits in intraday trading, you must conduct an extensive study. The goal is to ensure that when users speak of investments, their words come from a place of understanding and not just from information. To see our full methodology and learn more about our process, read our criteria for evaluating brokers. IG provides an execution only service. On the chart above, the price formed a double bottom setup at the end of a downtrend. For years, this fast fingered day trading crowd relied on Level 2 bid/ask screens to locate buy and sell signals, reading supply and demand imbalances away from the National Best Bid and Offer NBBO—the bid/ask price that the average person sees. Volatile stocks are targeted in such cases, and procured shares are sold off as soon as a massive movement in prices is witnessed. On an hourly chart, you will be able to spot reliable chart patterns that point to multi day or multi week trend changes in either direction. 15 mins This is applicable during the office hours to sole holder Resident Indian accounts which are KRA verified, also account would be open after all procedures relating to IPV and client diligence is completed.

17 Pipe Bottom and Pipe Top

INZ000174330 NSE CM, FandO, CD TM Code: 06537 Clearing Member FandO No. The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. The maximum leverage on forex is usually 30:1. Automated investing through Schwab Intelligent Portfolios® requires a minimum $5,000 deposit. Discover the endless trading possibilities with our cutting edge platform, designed to empower both beginners and seasoned traders alike. Truly great investments continue to deliver value for years. On the other hand, losing traders often fall victim to emotional trading. Depending on where you are in your crypto journey, you may be interested in different features. Hi Baptiste – if a robo advisor is preferred, have you ever checked to see whether the performance of Selma vs. How does the scalper know when to take profits or cut losses. One of the reasons includes low investments and the need for less manpower to function. Reg Office: Bajaj Auto Limited Complex, Mumbai –Pune Road Akurdi Pune 411035. Under the product selection process, we undergo extensive market research, finding different products and services in a particular category.

Associated Risks

Other fees: Inactivity fee £10 after 12 months, withdrawal fees variable. That’s because mixing funds can put your money or stocks at risk if a company is mismanaged. Murphy, candlestick patterns are highly reliable in trending markets, with an accuracy rate of approximately 70% when identifying continuation and reversal patterns in strong trend conditions. Securities quoted are exemplary and not recommendatory. Test new strategies without putting your capital at risk. As much as the COVID 19 pandemic took from our society, it ushered in a renaissance of people using the internet to make an independent living. Broker dealer https://pocket-option.click/ in 1993, and the company has since developed into one of the industry’s most complete online brokerage platforms. The content provided by Investtech. The equity options market is open from 9:30am 4:00pm EST; the same as normal stock trading hours. Past performance does not guarantee future results. Instead of letting emotion dictate whether to keep a position open, quants can stick to data backed decision making. Options investors can have a paper profit one day and a paper loss the next. It’s also about seamless integration with critical, no fee banking features and industry leading insurance. By being aware of common pitfalls and continuously improving their trading skills, traders can minimize losses and increase their chances of overall success. Profit and Loss Account is a Real Account. The exception to this rule is when the quote currency is listed in much smaller denominations, with the most notable example being the Japanese yen. Reviewed by Axel Rudolph, Senior Market Analyst. Securities and Exchange Commission. Swing traders are often not looking to hit a home run with a single trade. Already have a Self Study or Full Immersion membership. All securities including those on which derivative products are available will have a maximum price band of 5%. It takes time, practice, and experience to trade price swings. Before the cross occurs, we would consider this stage 1. Although Webull is not known as a social trading platform, the mobile app’s community feed is a place where users can share market ideas and strategies and ask questions of other members. A few apps offer cryptocurrency, but in our view cryptocurrency is best sourced through a reputable exchange. When the current market price is less than the average price, the stock is considered attractive for purchase, with the expectation that the price will rise.

Knowledge Centre

Amid 2022 concerns about inflation, the Russia Ukraine war and rising oil prices, options trading is growing. Buying and selling crypto on the Kraken app is definitely a hassle free process that doesn’t really leave space for failure. Forex rates are based on interest rate differentials between the pair’s currencies. Those strategies range from day trading, to longer term position trading. For example, assume an investor is long an option with a theta of 0. Thus, if the Pro version gets a bit too complicated for you, just switch to the Lite one. Day Traders must be swift to execute trades because a single loss could indeed wash out the entire day’s profit. This meant that the profit from a trade needed to exceed the amount paid to the broker. «Beginners’ Guide to Fundamental Analysis. Use the following pointers to improve your market selection efforts. Mene GTF ko join 2022 me keya tha aur vo mere life ka sbse best investment tha. Excellent features to help you trade easily in any segment you like. Reselling things for a higher price is not a new idea. This information has been prepared by IG, a trading name of IG Markets Limited. For example, charting on the mobile version of the Next Generation platform is just as impressive as the web version. Profit targets are the most common exit method. SteadyOptions has your solution. Imagine having a business plan where you could predict that every 9 in 10 traders will lose most, if not all, of the money they place in their brokering account. The corresponding price sensitivity formula for this portfolio Π displaystyle Pi is. While you should be wary of using the results of trades made in such an account to judge the success or failure of any one strategy, it will give you invaluable experience in the logistics of implementing those trades. Understanding the differences between scalping and day trading is crucial for traders so that they can better identify and choose the strategy that best aligns with their goals and risk tolerance. You sell a put option with a strike price of Rs 40. Use limited data to select advertising. Impressive trading platforms. Finally, you calculate the EMA using current and past prices, in tandem with the multiplier. In general, standard option valuation models depend on the following factors. In today’s digital age, innovative concepts are constantly emerging in the world of online commerce, and one of the latest trends to capture attention is color trading. How do I get into trading. The trading fees reflected for each brokerage or crypto exchange are the trading fees for the lowest volume of trade, using the most basic version of the platform. The account also automatically sets aside 30% of your portfolio as cash to protect you against market volatility.

Interested in joining us?

Bajaj Financial Securities Limited is not a registered Investment Advisory. A coffee exporter can also supply major chains of eateries and restaurants with several coffee shops with coffee. Registered Office: 40 02A, Asia Square Tower 1, 8 Marina View, Singapore 018960. Sensibull for Options Trading. Stash Banking services provided by Stride Bank, N. And it also allows for trading on margin with leverage. It is a fixed value determined by regulatory bodies or exchanges. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. TradingView Essential, Plus, and Premium are completely ad free, providing you with an immersive experience without any annoying ads. Vaishnavi Tech Park, 3rd and 4th Floor. Guwahati, August 14: About two months ago, Rajiv Saikia name changed on request was introduced to the mobile trading app, YBY, through an acquaintance. Your Mobile number and Email id will not be published. If you’re new to technical analysis, you might want to review the basics. I agree to terms and conditions. These are not exchange traded products and all disputes with respect to the distribution activity, would not have access to exchange investor redressal forum or Arbitration mechanism. For most investors, that’s a bit too much money to have in just one company, and a lot of investors, particularly beginners, won’t have $600 in their account. This is Richard, as known as theSignalyst. Choosing a broker will depend on your trading approach. Low turnover, principles of time tested investment approaches, returns with risk adjusted actions, and diversification are the key features of investing in a long term manner. The opposite also applies. Invest in the world’s biggest companies for as low as ₹1. The same idea applies to many patterns, including double top, triple top, triple bottom, head and shoulders, inverse head and shoulders, and Quasimodo. On your chosen trading platform, you can add the instruments you want to trade.

Company

If you buy a stock at $10 and it goes to $0, you’ve lost your entire investment. Similarly, in a country experiencing financial difficulties, the rise of a political faction that is perceived to be fiscally responsible can have the opposite effect. Suppose a trader wants to invest $5,000 in Apple AAPL, trading at around $165 per share. After you build your risk management system, make sure to practice it in every trade. He is a recognized expert in the forex industry where he is frequently invited to speak at major forex events and trading panels. At this time, most decentralized exchanges like Uniswap do not have verification processes for users. » Success is impossible without discipline. «I believe in analysis and not forecasting. App Store is a service mark of Apple Inc. This differs markedly from traditional «buy and hold» investment strategies, as day traders rarely maintain overnight positions, closing out all trades before the market shutters. Some brokers go a step further and allow you to purchase fractional shares, so you can purchase less than one share. They can provide clues as to the future direction of prices, as they often indicate that buyers or sellers are gaining or losing control of the market. With IG Market AnalystMonte Safieddine. Do not make payments through e mail links, WhatsApp or SMS. These models describe the future evolution of interest rates by describing the future evolution of the short rate. Long term investors, who also want to trade more frequently, should consider Fidelity Investments for both approaches. Chart patterns allow traders to glean insight into the markets, helping them make educated guesses on the price movements of stocks, and allowing them to make buy and sell decisions. EToro’s low minimum deposit requirement is attractive to novices seeking to start trading without a substantial initial investment. Earn a commission for copy trading and boost your income. Price, volume, insider information, corporate actions etc. The standard is called FIX Algorithmic Trading Definition Language FIXatdl. INZ000218931 BSE Cash/FandO/CDS Member ID:6706 NSE Cash/FandO/CDS Member ID: 90177 DP registration No: IN DP 418 2019 CDSL DP No. You can calculate options pricing using two different models. Instead, traders will make exchange rate predictions to take advantage of price movements in the market. Because of the sovereignty issue when involving two currencies, Forex has little if any supervisory entity regulating its actions. Most modern backtesting platforms come with an optimizer that enables you to find the best parameter settings for your strategy. Another thing that makes Interactive Brokers stand out is its trial option. One common issue with backtesting is identifying how much volatility a system will see as it generates returns. In the second case, we could even use a neckline retest as a second entry.

Final Thoughts:

A stochastic oscillator is another type of momentum indicator, like RSI. No worries for refund as the money remains in investors account. To determine the best trading platforms for beginners, our team of experts started by evaluating 24 brokerage firms and investment platforms — from large, legacy brokerages to relatively new financial technology fintech companies. Use profiles to select personalised advertising. Its new version is available on our website and can be easily downloaded and installed. To weigh those features, we analyzed hundreds of data points and conducted rigorous app trials. For some, it’s as simple as buying a put when bearish and a call when you’re bullish. Here are the online brokers with the best apps for trading in 2024. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. Digital assets held with Paxos are not protected by SIPC. Among these, the Moving Average MA stands ou. Bollinger Bands are a technical analysis tool created by John Bollinger in the 1980s. The value of your investments may go up or down. A seasoned player may be able to recognize patterns at the open and time orders to make profits. Clients: Help and Support. Professional access differs and subscription fees may apply. Film City Road, A K Vaidya Marg, Malad East, Mumbai 400097. We agree that this is the case, but that does not mean that algorithmic trading relieves you from all the psychological pressures that are associated with trading. For example, assume an investor is long an option with a theta of 0. What it doesn’t cover is a loss in the value of your investments. Before we get into scalping vs. This strategy consists of buying one call option and selling another at a higher strike price to help pay the cost.

Financial Advisors:

Investors’ discretion is required. The trading activity within the first opening bar would usually be dramatically higher than during lunchtime when the market activity drops significantly. You decide to buy 10 shares at $170. This allows users to practice trading in a risk free environment and familiarize themselves with the platform. By using trading strategies, traders can decide when to buy and sell, what volume to trade, and how to protect themselves from big losses. Create profiles to personalise content. It requires a deep understanding of the options market, as well as the ability to analyse market trends and make informed decisions. 64% of retail investor accounts lose money when trading CFDs with this provider. From the following Trial Balance of M/S Mitesh and Mangesh, you are required to prepare Trading and Profit and Loss Account for the year ended 31st March 2019, and Balance Sheet as on that date. Appreciate – Your all in one investment and savings app. During a range, our drawn lines will be horizontal, not angled. The funds that now remain in Bob’s account aren’t even enough to open another trade. They can also assess their current portfolio and adjust if they’re susceptible to common investment pitfalls. Our experienced mentors are available 10 hours a day, from Monday Friday to provide you with expert advice. Positional trading allows both fundamental and technical analysis to recognise a trend. Regular trading can involve holding positions for days, months, or years, while intraday trading requires closing positions within the same trading day. Also, as this style involves quick buying and selling, this is usually suitable for traders with small capital. A double top pattern is formed from two consecutive rounding tops. In addition to that, users can also download a wallet extension for the Chrome browser, which is definitely a plus. You’d trade using CFDs with us you’d buy or sell contracts to exchange the price difference of a financial instrument between the open and close position. Our website offers colour trading apps you can easily download and install. Step 7: Start Trading. Bringing US equities to users, Appreciate is shortly launching its AI enabled, seamless, hassle free App which will serve as comprehensive destination for ones international portfolio goals. Tastytrade offers a cash bonus of $50 to $5,000 for opening an account worth at least $2,000 depending on the size of the initial balance. The entities above are duly authorized to operate under the Exness brand and trademarks. Since CFDs are leveraged products, they give you increased exposure to the underlying asset at a fraction of cost. Owning the stock turns a potentially risky trade — the short call — into a relatively safe trade that can generate income. Normal Market Open Time: 09:15 hours.

Learn

A T shape profit and loss account has two sides debit and credit. At a certain point when you invest money, risk management becomes crucial. Crypto exchanges work a lot like brokerage platforms. The importance of identifying both uptrends and downtrends lies in the following aspects. He covers the personal finance beat. Proper due diligence has been done for the images and the image is not of any artist. But if they are put front and centre of an app, it generally means the company is targeting more sophisticated investors or perhaps even day traders. Their job is to be sensational and drive ratings. 00 commission to open per options contract, $0 commission to close per options contract. Commodity Futures Trading Commission. Clients: Help and Support. Note that ADX never shows how a price trend might develop, it simply indicates the strength of the trend. Client is requested to independently evaluate and/or consult their professional advisors before arriving at any conclusion to make any investment. «Day Trading: Your Dollars at Risk. An individual is considered a «pattern day trader» if they execute four or more day trades within five business days, given these trades make up over six percent of their total trades in the margin account during that period. The FDIC calculates the insurance limits based on all accounts held in the same insurable capacity at a bank, not just cash in Cash Reserve. It is not recommended to base your investment decisions on any information presented on or originating from BinaryTrading. The user assumes the entire risk of any use made of this information. The information contained herein is from publicly available data or other sources believed to be reliable. You dont have to be a professional trader to win big in the stock market. In intraday trades, you need to square off your position before the market closes. Robo advisors help you achieve your investment goals and manage your money—but if you’re not quite ready to let the bots take over, you can still get advice from a human financial advisor for more tricky cases. It does this by providing a score between 0 and 100. With this strategy, traders adopt a deliberate approach, assessing intraday price action, market trends, and fundamental factors e. Use limited data to select advertising. OI is a useful indicator for options traders as it helps them to understand the market sentiment. Maximize your exposure to the underlying market with automated buy and sell orders. Now, how big it could get is a completely separate matter, and it also depends on the firm owner’s trading skills. Strong research offering.

Is this algorithmic trading guide really free?

These firms typically provide trading on margin allowing day traders to take large position with relatively small capital, but with the associated increase in risk. We will examine a few popular indicators used by traders to scalp trade. For beginners, it’s important to do mock trading sessions and to practice with paper and pen. Let us explain how it works to help you get started. You should wait until the price moves up to the downward sloping trendline. Wealth managers can meet evolving expectations of their clients and capture the growing market of active investors with hyper personalisation, updated information on taxation and governance, and add newer asset classes. This is completely fine too, and is really a matter of preference. Going forward, you should look to expand your price action trading understanding and knowledge as there is much more to it than is covered here.

Basic Plan

An option is a contract that’s linked to an underlying asset, e. One lot of GBP/USD is equivalent to $100,000, so buying the underlying currency unleveraged would require a $128,600 outlay ignoring any commission or other charges. A Cost of materials consumed. Pennant patterns, or flags, are created after an asset experiences a period of upward movement, followed by a consolidation. An example of the importance of news reporting speed to algorithmic traders was an advertising campaign by Dow Jones appearances included page W15 of The Wall Street Journal, on March 1, 2008 claiming that their service had beaten other news services by two seconds in reporting an interest rate cut by the Bank of England. Trading and investing in financial markets involves risk, and it is important to do your own research and consider seeking advice from a financial and/or tax professional before making any investment decisions. In the delivery trade, you can hold a stock overnight or as long as you want. Swing trading involves opening and holding a position or multiple positions for a few days or weeks and then closing it. For instance at 10:25 am he may decide to buy half of his selling position, because the price just touched the main support trendline. Unlike day trading’s frenetic pace, swing trading thrives on holding positions for a span spanning from a few days to several weeks, with the typical duration hovering around 2 3 days. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. The exponential moving average EMA. However, even many of the best investment apps offer options trading, so you won’t have too much trouble gaining access. You need to keep up with your paperwork, licenses, accounting, and other obligations. Market authorities determine trading schedules and hours for different commodities. It’s all handled automatically by the investment platform too. Use limited data to select advertising. It’s useful when you want to enter or exit the market and don’t care about getting filled at a specific price. Company address: 35 Barrack Road, 2nd Floor, Belize City, Belize, C. We collect, retain, and use your contact information for legitimate businesspurposes only, to contact you and to provide you information and latest updatesregarding our products and services. The market is largely made up of institutions, corporations, governments and currency speculators – speculation makes up roughly 90% of trading volume and a large majority of this is concentrated on the US dollar, euro and yen. The price might retrace slightly after the breakout before continuing its upward momentum.

Ventura Wealth Clients Login here

In the United States, based on rules by the Financial Industry Regulatory Authority, people who make more than 3 day trades per 5 trading day period are termed pattern day traders and are required to maintain $25,000 in equity in their accounts. 60% of retail investor accounts lose money when trading CFDs with this provider. List of features and benefits. You can trade energies, Forex, metals, CFDs, indices, futures, and shares on login. You need to put in the work. These create a series of candles which produce a bearish «event,» per se. To be a successful position trader, you’ll need to use a mix of fundamental analysis and technical analysis to evaluate potential market trends and risks before opening a trade. » Learn more about the various types of stocks. He asks himself, «WTF just happened. Beginners wanting to test out trading forex in a simulated trading environment can try out their strategies on the paperMoney platform on thinkorswim. The site may contain ads and promotional content, for which PipPenguin could receive third party compensation. Self guiding learning is powerful because you go at your speed. Read the Privacy Policy to learn how this information is used. On the other hand, other commodities such as metals, bullions and energy products can be traded up to 11:30/11:55 pm. Earn up to 3% extra on annual contributions with Robinhood Gold Get 1% extra without Robinhood Gold, every year. This includes ‘novice’, like how to be a successful day trader, up to ‘expert’ – looking at technical indicators that you’ve perhaps never heard of.

Follow us at

As a trader, your objective is to make profits, and not place lots and lots of trades, which would normally just result in your broker getting rich. Individual traders typically day trade using technical analysis and swing trades—combined with some leverage—to generate adequate profits on small price movements in highly liquid stocks. Smart Strategies to Pick Stocks. Below is a systematic guide to trading M patterns, incorporating essential pattern trading rules every trader should follow. The Marubozu pattern is a candlestick with a long body with no shadows. Note that for the simpler options here, i. Last Updated on October 27, 2023. Apple, iPad, and iPhone are trademarks of Apple Inc. To develop a robust trading mindset, it takes time and a certain level of patience to learn from successes and mistakes. Once the swing trader has used the EMA to identify the typical baseline on the stock chart, they go long at the baseline when the stock is heading up and short at the baseline when the stock is on its way down. In this section, we will delve into the significance of both liquidity and volatility in the context of day trading, offering insights and real world examples. SEBI Registration No INZ000200137 Member Id NSE 08081; BSE 673; MSE 1024, MCX 56285, NCDEX 1262. Swing trading is like position trading, but the swing trader would look to identify swings in both directions within the primary trend. If the price rises and reaches your specified strike price, the order would turn into a limit or market order, which would close your position and limit your losses on your short position. Each tab in TradesViz is designed to maximize efficient insights gathering. Is there any other advice you’d offer someone who’s considering using a stock trading app. Here are a few key factors to keep in mind when looking for the W pattern in trading. Economists, such as Milton Friedman, have argued that speculators ultimately are a stabilizing influence on the market, and that stabilizing speculation performs the important function of providing a market for hedgers and transferring risk from those people who don’t wish to bear it, to those who do.